If you dont try, You will never know

Take Any Plan

Get ALL Indicators Access for 1 Months

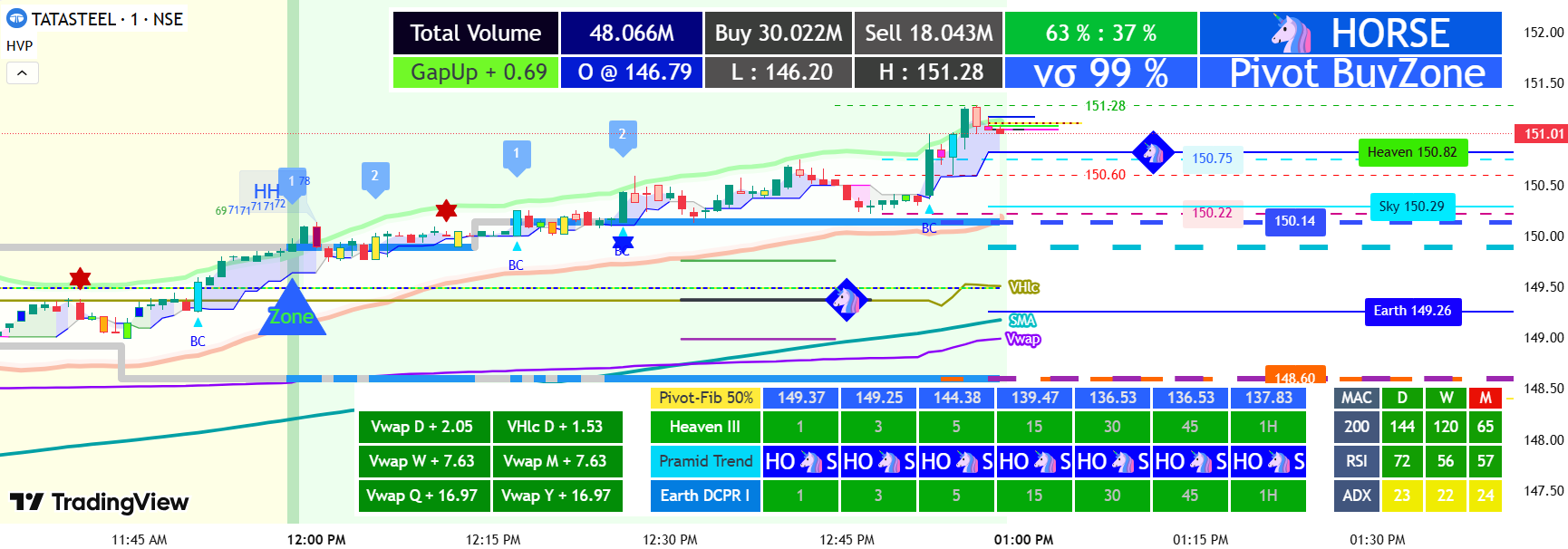

Horse Volume Pivot

Take your trading to the next level with Horse Volume Pivot. Our powerful tool provides actionable insights, helping you:

- Identify key support and resistance levels.

- Anticipate potential price reversals.

- Understand market sentiment and momentum.

- Optimize your entry and exit strategies.

Volume

Bull and bear are old days, Bifurcation was the need to beat the old trading system where most of the traders had made losses. Now we have a Horse it represents that is higher than a bull and Donkey its lower than a bear.

The ability to make considered decisions or come to sensible conclusions based on buy sell percentage ratio. Shows the total buy and sell volume, based on the high buying power it shows as a horse and high selling its donkey. For mid-level, it's Bull & Bear.

Pivot Trend (Pivot Pyramid Theory)

The Pivot Pyramid Theory introduces a unique perspective on trend analysis. It envisions three key levels: Earth, Sky, and Heaven. These levels represent dynamic support and resistance zones that can shift as the market evolves.

**Operator Up Button:**

- Earth, Sky, Heaven: When the trendlines are aligned in this order, it indicates a bullish trend. The Earth level acts as strong support, while the Heaven level serves as significant resistance. The Sky level often acts as a potential resistance or a retest point before the price moves higher.

**Operator Down Button:**

- Heaven, Sky, Earth: When the trendlines are reversed, with Heaven below Earth, it signals a bearish trend. The Heaven level becomes a strong resistance level, while Earth acts as strong support. The Sky level can act as a potential support or retest point before the price declines further.

The Earth-Sky-Heaven Alignment strategy (also known as "Riding the Horse Wave") is useful across all timeframes, it is best utilized and evaluated on second timeframes, especially 5-10 or 30-second charts.

Dynamic CPR (DCPR) and the Pivot Pyramid: A Layered Approach to Trend Identification

The Dynamic CPR (DCPR) recalculates levels continuously as new price data emerges, adapting to real-time price action. This dynamic nature provides a more accurate reflection of the current market state.

The DCPR Pivot Pyramid organizes these dynamic levels into a layered trend structure, offering a more nuanced perspective than simple bullish or bearish classifications. Relying solely on basic trend identification can often lead to losing trades. The DCPR Pyramid delves deeper, revealing micro-trend details and significantly improving trade entry decisions.

The DCPR Pyramid is divided into five distinct trend layers:

- Blue (Horse Trend): Represents a strong, extreme upward trend.

- Green (Bull Trend): Indicates a moderate upward trend.

- Gray (Neutral/Hunting Zone): Represents a zone of indecision, typically situated near the extreme (Horse) trends. This area is characterized by potential stop-loss hunting behavior, where price may briefly move against the prevailing trend before either resuming the extreme trend or reversing into a bearish trend.

- Pink (Bear Trend): Represents a developing downtrend and acts as a risk management signal in uptrends. During a downtrend, even if price rallies while the Pink layer is present, avoid counter-trend long (buy) positions, as the prevailing downward momentum suggests a high probability of further decline toward the Donkey Trend.

- Black (Donkey Trend): Represents a strong, extreme downward trend.

Active trend identification : Is facilitated by above animals symbols displayed at the "heaven" level.

By understanding these five layers, traders can gain a more comprehensive view of market dynamics, avoid false signals, and make more informed trading decisions.

DCPR Convergence: Enhanced Multi-Level Pivot Breakout Detection.

When a single candle breaches all three "Earth," "Sky," and "Heaven" pivot levels, it signals increased volatility and a strong trend capable of breaching subsequent levels. The DCPR Signal offers multi-level breakout confirmation, filter out noise and identify robust breakouts, leading to improved trading opportunities. Alerts have been integrated for this strategy. Explore its performance across various timeframes, with optimal results observed on higher timeframes.

Multi-Timeframe DCPR Trend Dashboard

Navigate complex market trends with ease using the Multi-Timeframe DCPR Trend Dashboard. This innovative tool provides a holistic view of DCPR trends across multiple timeframes.

Key components:

- Heaven: Represents the highest point of recent price action.

- Pyramid Trend: Visually indicates the active trend.

- DCPR Earth: Serves as a crucial dynamic center point and a key support/resistance level.

Price trading above DCPR Earth suggests positive sentiment, while a move below suggests a potential downtrend.

By combining these elements, the dashboard empowers traders to make more informed decisions and enhance their overall trading strategy.

Pivot Zone

It's the horizontal section stretching from left to right that divides buy and sell layouts by zone. When the price "breaks" through a pivot level (support or resistance), it suggests that the market is shifting. A break above a resistance pivot could indicate bullish momentum, while a break below a support pivot might indicate bearish momentum. Pivot Zone can signal a change in market sentiment and often leads to the stock's price either moving further in the direction of the breakout or possibly reversing direction.

Pivot Zone Background color, highlighting.

Buy = (Blue Zone) Sell = (Orange Zone)

PivFib (Pivot Fibonacci or Pivot Five)

It's the vertical section stretching from down to up with 3 Inside Pivot Lines based on a 25%, 50% & 75% rule to classify 4 Inside Trend. It refers to identifying key levels (support and resistance) inside the pivot calculated from the recent swing high and low dynamically. This technique is used to anticipate possible price reversals or trend continuation.

PivFib Trend: Trend strength is visually signaled at the 50% level with animal symbols: Horse (Strong Bullish), Bull (Bullish), Bear (Bearish), Donkey (Strong Bearish).

Internal Pivot Breaks (IPB)

An "internal pivot" can refer to a short-term support or resistance level that is within a broader trend or pivot zone. These could be levels formed by smaller price swings within a larger pivot. Internal pivot breaks are often used as early warning signals for change in direction or continuation.

Label as IPBU (Up) and IPBD (Down)

Pivot Zebra lines (Price Action)

Pivot Zebra lines are calculated for different swings at various levels and in continuation-extended. These lines are colored green-yellow for bullish and black-yellow for bearish.

Longer lines indicate higher liquidity on breakout. When the price reaches these levels, it may experience increased volatility and potential price reversals.

Candlestick Patterns, Colors Highlighting

For improved trading setup identification, I've added clean visual cues (colors and symbols) to highlight key candles on the chart.

Among the high-probability candles I track, two very important candles are particularly noteworthy: the Blue gap up candle (Highest Buying Pressure) and the Black gap down candle (Highest Selling Pressure). (

Rsi Candle

When a candle moves outside the Bollinger Bands, its RSI value is displayed on the candle

Big Candle (Indication of Strong Momentum)

A big candle often signals strong momentum in the market. When you see a big bullish candle, it indicates that buyers were in control during that period. Conversely, a big bearish candle signals that sellers were dominant. These candles are highlighted with lime (bullish) and pink (bearish) colors and labeled as "BC."

Most Important Moving Averages based on priority order

Multi-Timeframe-VWAP refers to the calculation of Volume-Weighted Average Price (VWAP) over different time intervals, such as daily, weekly, monthly, quarter and year. By analyzing VWAP across multiple timeframes, traders can gain a more comprehensive understanding of market trends and potential trading opportunities.

VHLC (Volume-Weighted Highest, Lowest, Close) is a technical analysis concept often used to assess price action, factoring in volume at different price levels. It combines volume with price data to create a more accurate reflection of how the market is behaving. Useful in scalping strategy.

Long-term Dashboard - Timespan Mastery: The Trader's Edge

MACD: Validating Trend Strength Across Timeframes. Confirm the sustainability of trends by observing MACD Histogram consistency across daily, weekly, and monthly charts, minimizing false signals and maximizing trend-following profits.

200 SMA: Timespan-Adaptive Market Intelligence. Gain a strategic edge with the 200 SMA: decipher short-term sentiment (daily), validate long-term health (weekly), and illuminate generational macro trends (monthly). This empowers data-driven strategies for all investment horizons.

RSI: Pinpoint precise entries and exits by identifying momentum and overbought/oversold levels across all timeframes, maximizing profit potential.

ADX: Validate setups and optimize portfolios for sustained gains by confirming trend strength and direction across all timespans.

Multi-timeframe analysis of RSI and ADX, coupled with MACD and the 200 SMA, delivers a comprehensive view of momentum and trend, empowering confident, data-driven decisions while minimizing risk.

VWAP YQM (Yearly, Quarterly, Monthly) Convergence Breakout

To filter false signals and prioritize YQM trend continuation, breakouts are confirmed only after price breaks the relevant pivot level. First bullish breakouts near the YQM convergence are highlighted in yellow, with subsequent bullish breakouts turning green. For downtrend First bearish breakouts are highlighted in black, with subsequent bearish breakouts turning red.

Importance of Pivot Breakout Counters:

"The breakout counters are crucial for validating the strength of potential breakout signals. They track the number of consecutive price breaches above the upper band or below the lower band. This consecutive count acts as a filter, distinguishing genuine trend continuations from mere price fluctuations. A higher count signifies stronger momentum and increases the probability of a sustained move in the breakout direction. By requiring a user-defined number of consecutive breakouts before triggering alerts, the script significantly reduces the risk of false signals and enhances the reliability of the generated trade signals. This feature allows traders to focus on high-probability setups and avoid premature entries based on fleeting price action." Harness the power of Customizable Breakout Alerts.

Live Candle Levels :

Visualize Key Price Action. Project the previous candle's open, high, low, close, and midpoint in real-time providing a clear view of potential support and resistance levels for strategic trading decisions.

Real-Time Esoteric Candle Assessment with Status:

Observe and interpret live candle formation with dynamic status indicators, allowing for informed probabilistic analysis of potential outcomes.

It's like a live analysis tool that gives you instant feedback on each candle. As the candle moves, the script shows you the animal status with color (In Circle Symbol) that changes along with it, helping you see the candle's story as it unfolds."

The animal status shown at the very start of a candle offers an early glimpse into potential momentum. Observing which animal appears as the candle opens can provide valuable insight into the likely direction of the candle's movement, suggesting a higher probability of the price continuing in that initial direction.

Note 1 : "It's important to use alerts correctly." Please refer to this YouTube video to understand the concept of creating alerts.

Note 2 : "We strongly recommend enabling alerts on your Watchlist to take full advantage of its features."

Release Notes

Jan 5 2025

Stay ahead of the market with new VWAP YQM Convergence Alerts. This feature notifies you of a rare but highly significant event when yearly, quarterly, and monthly VWAPs meet at a common price. This indicates that traders across multiple timeframes agree on a key price, creating a highly significant support/resistance level. A break of this level often leads to a continuation of the prevailing trend, providing high-probability trading opportunities.

Jan 16 2025

Introducing the DCPR Pivot Pyramid Trend, designed to address the false signals often generated by simple trend lines. Unlike static traditional CPR, Dynamic CPR adapts to real-time price action. With the Pivot Pyramid, DCPR levels are now organized into five distinct trend layers: Horse, Bull, Neutral, Bear, and Donkey. This enhanced layered approach filters out market noise to increase the accuracy of trend identification and inform better trading decisions.

Feb 06 2025

Multi-Timeframe Fibonacci: Precision, Trend Identification, and Equilibrium. This workhorse analysis elevates your strategic advantage. By visualizing the 50% retracement across multiple timeframes, traders identify key points of equilibrium, achieve a broader market perspective, and empower their decision-making with a profound understanding of market dynamics.

"Gain a strategic advantage by implementing alert strategies tailored to various timeframes, utilizing watchlists alerts to identify high-probability trading opportunities and maximize profits."

Rs: 123 (3) Month

Rs: 950 Lifetime

2$ (3) Month

$15 Lifetime

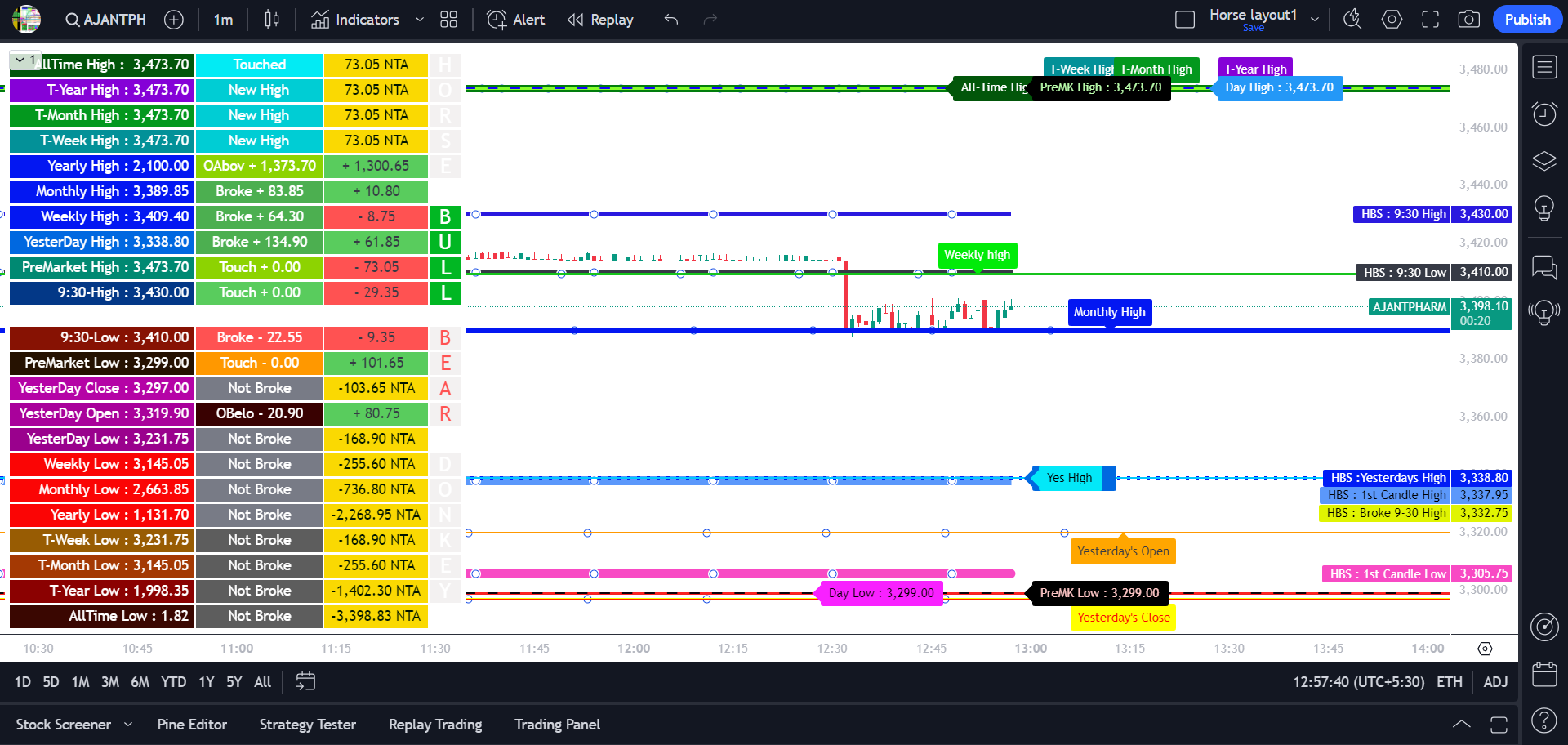

Every single stock has a journey. It travels frequently and creates stations known as breakout levels. Just like a traveler navigating a journey, every stock moves through phases, establishing significant price levels. These levels, often referred to as breakout points, function as support and resistance zones. By understanding the current position of the stock relative to these levels and anticipating its future trajectory, traders can optimize their entry, exit, and holding strategies.

Understand what level the stock is at and where it is heading.

Horse Breakout Stations categorize these key points into four categories:

- Bull and Horse Stations: Represent significant highs, such as yesterday's high, weekly high, and yearly high.

- Bear and Donkey Stations: Indicate significant lows, like yesterday's low, weekly low, and yearly low.

Horse Breakout Stationsl Levels show all periodic levels. Some clear explanations of the levels for understanding can be found below. (1st column)

- Yearly High, Monthly High, Weekly High: The high is calculated for the PAST, year, month and week (Consistent breakouts of Past highs can indicate a strong uptrend.)

- T-Year High, T-Month High, T-Week High: T stands for "this" current year, month and week (Once the stock reaches this weakest level, it becomes no trading zone, (Sideways) suggesting a lack of clear upward or downward momentum. Trading activity is discouraged for the day.)

- Pre Market High & Low: Are dynamically updated based on the session and displayed on the chart.

- 9:30 Trend High & Low: This is the 9:30 candle on the basis of which the high-low level is created and displayed on the chart.

Interpreting Station Status (2nd column)

The dashboard provides station status information. Key abbreviations used are- Not Broke: The station has not been breached.

- Broke +78: The station was broken, and the price surged by 78 points.

- Broke -76: The station was broken, and the price declined by 76 points.

- OAbov stands for Opened Above

- OBelo stands for Opened Below

- YD Broke stands for Yesterday Broke

- Below satisfies that it is below the closing price

- New High: means that the level has been updated with the current new High reached today. (Applies to T-Yearly, T-Monthly, T-Weekly and All-time)

The third column quantifies the price movement of each station relative to the closing price (3rd column) To view this choose full or minimal dashboard style.

- NTA (Need to Achieve): The level is yet to be reached. (highlighted in yellow)

- Positive green are rising values

- Negative red are falling values

9:30 candle level

- This station represents the high and low of the first 15 minutes of the trading session. A broken 9:15 high is often a significant bullish signal. When the 9:15 high is broken on the chart, a yellow stepline is displayed above the candles indicating it's the session 9:30 high for the day.

Interpreting Station Signals (4th column)

- The dashboard's fourth column uses color-coding to visually represent the strength of each station: Horse (strong bullish) Blue, Bull (bullish) Green, Bear (bearish) Red, Donkey (strong bearish) Pink, and Neutral (indeterminate) Gray.

- When the stock price trades within the first candle's high and low, it often exhibits sideways, unidirectional movement. This range typically lacks strong directional bias, increasing the risk of potential losses. Trading within this range is generally discouraged.

- Caution: Gray stations are high-risk no-trade zones. Entering this station often leads to losses. (100%). Unless there is important level within it.

New Updates Include:

"Horse Breakout Stations" now includes "Buy/Sell/Reversal Alerts" for automated, faster trading. Get instant alerts recommended to use with watchlists.

Gain Clear Visual Confirmation of Trading Signals:

Instantly visualize trading signals with distinct, easy-to-read labels directly on your chart. "B" (Buy), "S" (Sell), "BR" labels indicate Buy Reversal, and "SR" labels indicate Sell Reversal labels provide clear directional cues, eliminating ambiguity.

Receive Timely and Actionable Real-Time Alerts:

Never miss a critical trading opportunity with instant alerts. Alerts provide precise signal details, including type, direction, and symbol, enabling swift trade execution.

Customize Signals to Align with Your Unique Strategy:

Tailor the indicator to your specific trading style with easy-to-configure input parameters. Choose between "Pure" and "Trend Reversal" signals and select your desired timeframes for optimal performance.

Reduce Trading Risk and Improve Decision Making:

Crucially, this update empowers you to avoid entering trades at bad times, and to enter trades at optimal times.

Note 1 : "It's important to use alerts correctly." Please refer to this YouTube video to understand the concept of creating alerts.

Note 2 : "We strongly recommend enabling alerts on your Watchlist to take full advantage of its features."

Release Notes

Jan 24 2025

Discover Market Clarity with the Enhanced Horse Breakout Stations. Featuring customizable dashboards that display market data relevant to your trading strategy. Visually appealing and efficiently organized labels enable effortless identification of station levels, empowering you to enhance your market analysis and make more informed trading decisions.

Mar 26 2025

Enhance your trading with "Horse Breakout Stations." The new "Buy/Sell/Reversal Alerts" feature automates your trading and accelerates opportunity detection. Eliminate manual chart analysis, saving you significant time by automating the detection of key weekly, monthly, and yearly breakouts and reversals. Receive instant real-time alerts and visual labels, revealing high-probability entry opportunities at critical market levels, where liquidity influences price movement.

Rs: 123 (3) Month

Rs: 950 Lifetime

2$ (3) Month

$15 Lifetime

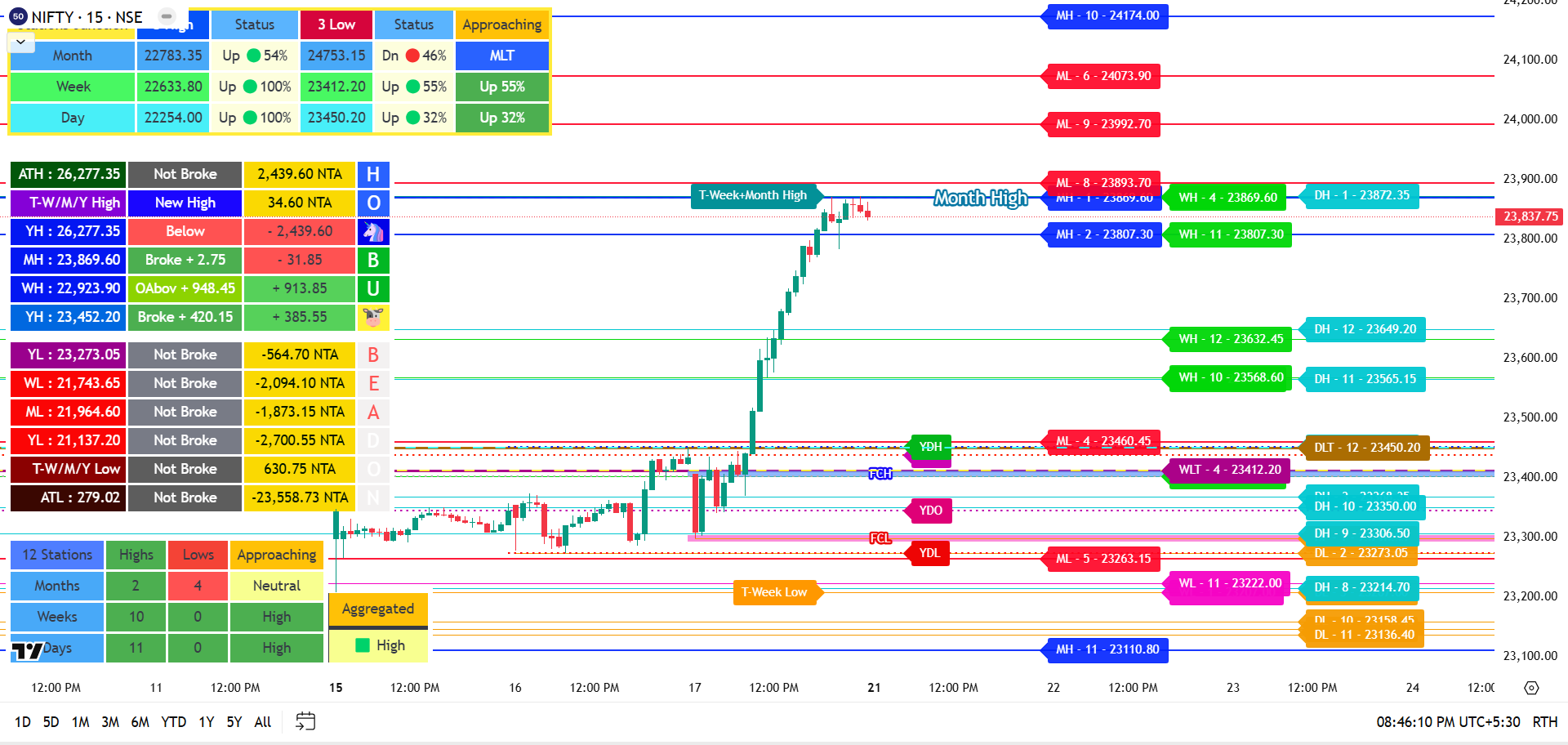

The key to unlocking true trading mastery. Horse 12 Stations Aggregated Approach, a powerful tool that goes beyond common high/low analysis.

Unlock a new dimension of market mastery with the Horse 12 Stations Aggregated Approach indicator. This isn't just another indicator; it's a strategic weapon forged from a distinctive methodology that dissects price action across 12 critical high and low "stations." At its core lies the potent analysis of MLT (Monthly Lowest Top) – the highest low among the last 12 monthly lows, pinpointing hidden long-term support – and MHB (Monthly Highest Bottom), revealing significant monthly resistance. It unveils high-conviction zones where aggregated power can trigger explosive moves. Elevate your trading to an unprecedented level of precision and foresight.

Stations Junction: Navigating Key Price Thresholds

The "Stations Junction" dashboard offers a concise yet powerful lens into the immediate price action relative to critical high and low thresholds identified across the monthly, weekly, and daily timeframes. Think of it as a central point for understanding the ongoing battle between potential support and resistance, derived from the "Horse 12 Stations Aggregated Approach." This dashboard focuses on the most recent significant turning points – the "High Bottoms" and "Low Tops" – to provide traders with a rapid assessment of the current market context and potential short-term biases. By monitoring the price's position and momentum around these levels, traders can gain valuable insights into potential breakouts and reversals.

Clarify "3 High" and "3 Low":

"3 High" Levels: Column labeled "3 High" (Representing the Monthly High Bottom - MHB, Weekly High Bottom - WHB, and Daily High Bottom - DHB)

"3 Low" Levels: Column labeled "3 Low" (Representing the Monthly Low Top - MLT, Weekly Low Top - WLT, and Daily Low Top - DLT)

Percentage to MHB/MLT (or similar key levels): Show the exact percentage distance of the current price specifically to the nearest key station level. This gives a more immediate sense of how close the price is to a potential turning point.

In essence, the "Approaching" column serves two vital roles: first, it indicates the prevailing sentiment within the established "station" range by showing whether the price favors the high or the low. Second, and perhaps more importantly, it provides Breakout Quantification: Once a "station" level is decisively broken, it immediately switches to indicating the direction of the breakout and the percentage of the initial range that the price has extended beyond that broken level. Empowering traders to quickly evaluate the significance of the move.

Visual Clarity and Customizable Focus: The color-coded levels for Monthly, Weekly, and Daily timeframes ensure clarity on your chart. The ability to toggle the display of "All Stations" or just "Key Stations" allows you to tailor the information to your specific trading style and risk appetite.

Alerting System:

The indicator includes a comprehensive alerting system. Users can enable alerts for price crossing both the "Key Stations" and the "sub-stations" for each of the three timeframes. This allows traders to be notified of potential breakout or breakdown events as they occur.

Alright, viewing the Nifty 50 index here in Mumbai, and having set up alerts on my custom watchlist of all 50 Nifty constituents using the "Horse 12 Stations Aggregated Approach" indicator, my alert system would be actively monitoring each stock for breaches of their key Monthly, Weekly, and Daily High Bottom (HB) and Low Top (LT) levels.

Here's how I'd be experiencing those alerts in real-time:

Individual Stock Alerts: As each of the 50 Nifty stocks experiences a price break above its MHB, WHB, or DHB, or falls below its MLT, WLT, or DLT, I would receive a specific alert. This alert would ideally tell me:

- Which stock triggered the alert: For example, "Reliance Industries - Broke above Daily High Bottom." or "Infosys - Fell below Weekly Low Top."

- The timeframe of the broken level: Indicating whether it's a monthly, weekly, or daily key station.

- The direction of the break: Clearly stating "above" or "below."

- Potentially the price level of the break: This would be very useful for confirmation.

Volume of Alerts: Depending on the market activity and the volatility of the individual Nifty stocks, I could receive a flurry of alerts, especially during periods of high volatility or significant market-wide moves. Conversely, during calmer periods, the alerts might be less frequent.

Focus on Key Levels: Because I've likely prioritized "Key Stations" (MHB, MLT, WHB, WLT, DHB, DLT) for my primary alerts, I would be most immediately notified of potential significant trend changes or breakout/breakdown events on these more influential levels.

Filtering Minor Alerts: If I've also enabled alerts for "Minor Stations," I might receive more frequent notifications for smaller, potentially less significant price movements. I would need to manage these alerts based on my trading strategy and risk tolerance.

Example Scenario:

Let's say the Nifty 50 is experiencing a broad bullish morning. I might receive alerts like:

- "ICICI Bank - Broke above Daily High Bottom at ₹1150.50."

- "HDFC Bank - Broke above Weekly High Bottom at ₹1585.20."

- "Tata Consultancy Services - Broke above Monthly High Bottom at ₹4200.00."

These alerts would immediately draw my attention to potential long opportunities in these key Nifty constituents.

Conversely, if there's a sudden bearish downturn, I might see alerts like:

- "State Bank of India - Fell below Daily Low Top at ₹820.10."

- "Axis Bank - Fell below Weekly Low Top at ₹1090.75."

These would signal potential short opportunities or the need to review my long positions.

By setting up these alerts across the entire Nifty 50 watchlist, I aim to leverage the "Horse 12 Stations Aggregated Approach" indicator to proactively identify potential trading opportunities as they emerge within the Indian market's benchmark index.

12-Station Bull/Bear Count

It counts how many times recently the price has been going up past old highs (green numbers).

It counts how many times recently the price has been going down past old lows (red numbers).

Based on these counts, it gives a single overall guess for the short-term: "Up" (green), "Down" (red), or "Neutral" (yellow).

Aggregated Approach:

Shows the short-term bias (Up/Down/Neutral) based on the 12-Station Bull/Bear Count

The "Horse 12 Stations Aggregated Approach" indicator promotes a proactive and informed approach to trading. Its dynamic level identification, customizable alerts, and aggregated bias assessment work together to highlight potential turning points and breakout opportunities, allowing traders to anticipate market movements and strategically plan their entries and exits.

Will add a Video Stay Connected

Rs: 1300 Month

$15 Month

Not for Lifetime

See the market's true momentum with this advanced indicator. It intelligently monitors the performance of three powerful, distinct trend-following strategies—Hybrid EMA (HEMA), Arnaud Legoux Moving Average (ALMA), and Triple Exponential Moving Average (TEMA)—all in a single, intuitive display. This tool is designed to show you precisely which moving average logic is best suited for the current market conditions.By integrating ADX for trend filtering and requiring a configurable number of Heikin Ashi-aligned bars for signal confirmation, it aims to identify higher-probability trend-following entries, primarily through the analysis of win rates to pinpoint which strategies have historically been more successful in capturing specific trend directions. It's clearly part of a larger, more comprehensive trading system.

Win Threshold-Based Color:

It represents win rate performance by assigning colors according to established thresholds (75%+, 50%+, 25%+, and below). Yellow, blue, lime, and orange act as visual cues, enabling traders to quickly assess whether a strategy's win rate falls within a high, medium, or low success range. This allows traders to quickly discern which approaches demonstrate superior historical success.

Backtesting metrics:

The indicator displays detailed performance statistics for each strategy in a table at the top center of the chart, including total trades, long/short trade counts, win rates, and average/maximum trade duration (in bars).

Live metrics:

It also shows a table at the top right with real-time information about any currently open trades for each strategy, including current profit/loss and the number of bars since entry. Buy and sell strategy signals are plotted directly on the price chart with labels. Additionally, it presents an Adx table with the power percentage values of Bull & Bear (+DI and -DI).

The core purpose of this script is to provide a consolidated view of the backtesting performance and current trading status of three different moving average-based strategies within a single indicator. It allows traders to:

- Monitor strategy effectiveness: By displaying win rates and trade statistics for each strategy, it helps assess their individual performance.

- Track concurrent trades: The real-time trade information table provides an overview of any active positions across all three strategies.

- Visualize entry points: The plotted buy and sell signals offer a visual representation of when each strategy would have entered a trade.

- Analyze trade duration: The average and maximum bar counts for closed trades can give insights into the typical holding times for each strategy.

- Utilize trend confirmation: The "Trigger Count" and ADX filtering aim to ensure trades are taken in the direction of a defined trend.

This knowledge empowers traders to selectively deploy the most suitable strategy for prevailing market conditions and to manage their active trades with a deeper understanding of their inherent probabilities.

Ultimately, this indicator is a robust Trend Confirmation Toolkit, designed to instill greater confidence in trend-following decisions by providing traders with the historical insights to select trend-aligned strategies wisely and the live data streams to manage those positions effectively as trends unfold. This unified view fosters a more informed and strategically agile approach to trading confirmed trends.

Trading Rules ...

Rs: 1300 Month

$15 Month

Not for Lifetime

Horse's Eye View: Spotting VCP Opportunities

This VCP scanner is a powerful tool designed to help traders capitalize on the potential energy buildup that occurs during Volume Contraction Patterns. By monitoring daily, weekly, and monthly charts simultaneously, it offers a comprehensive view of potential breakout opportunities. Here's a detailed look at its features and benefits:

The indicator automatically analyzes and scans price action on multiple timeframes (daily, weekly, and monthly). Its algorithm identifies valid "Volume Contraction Pattern" (VCP) setups. It uses a specific algorithm to detect the characteristic contraction pattern of lower highs and higher lows, looking back at the last best periods. This multi-timeframe VCP check is likely part of a larger trading strategy.

Visual Aids and Dashboard:

- Pivot Point Lines: The indicator plots the calculated daily, weekly, and monthly pivot high and low levels as lines directly on the chart, making it easy to visualize potential breakout zones. Users can customize the line style and labels.

- Real-time Breakout Detection: The script continuously monitors price action and, on breakout, shows an arrow with the label of the timeframe where the breakout occurred.

- Informative Dashboard: A table is displayed on the chart, providing a quick overview of the VCP status for each timeframe. It shows whether a VCP is "Active," "Inactive," or has just "Started" (meaning the VCP pattern has been detected and the trend is ongoing). "Increase TF" symbolizes that the VCP cannot be fetched. Change to a higher timeframe to know the exact status. The table also displays the VCP pivot high and low values.

Alerting System:

- Customizable Alerts: The indicator offers a highly customizable alerting system. Traders can choose to receive alerts for:

- Breakouts on individual timeframes (e.g., only daily breakouts).

- Convergence breakouts (e.g., daily/weekly convergence).

- Convergence Alerts: A key advantage of this scanner is its ability to detect convergence. This occurs when breakouts happen on multiple timeframes concurrently (e.g., a buy breakout on both the daily and weekly charts). Convergence signals a potentially stronger move as multiple timeframes align.

Note 1 : "It's important to use alerts correctly." Please refer to this YouTube video to understand the concept of creating alerts.

Note 2 : "We strongly recommend enabling alerts on your Watchlist to take full advantage of its features."

Recommended Timeframes for VCP Breakout Detection

While our indicator works across all timeframes, we recommend using the "D" day timeframe for observing VCP breakouts. For alert activation, use the following lower timeframes to capture breakouts on their respective timeframes:

- Daily Breakouts: 1-minute timeframe

- Weekly Breakouts: 5-10 minute timeframe

- Monthly & Converging Breakouts: 15-30 minute timeframe

Important Note: Due to the nature of price action on very short timeframes, some VCPs may not be readily apparent, which could impact alert triggering. Therefore, the above timeframes are specifically recommended for reliable VCP breakout alerts.

Benefits for Traders:

- Swing Traders: Early Entry: Swing traders aim to capture quick profits. The VCP helps them enter a trade early in a breakout, right as the stock is starting its upward move. This allows them to ride the momentum and maximize potential gains before the move fizzles out. They get in closer to the "bottom" of the move. A breakout from a VCP on a higher timeframe (e.g., daily or weekly) can signal a multi-day move.

- Positional Traders: Positional traders look for stocks with strong underlying momentum that are likely to continue their upward trend. The VCP often forms within these uptrends, signaling a temporary pause before the next leg up. This increases the odds of the trade working out. It shows the stock is "resting" before another potential move up.

- Scalpers: Rapid Breakout Identification: Scalpers thrive on capturing quick price movements. The indicator's real-time breakout detection and alerts enable scalpers to quickly identify and act on short-term breakout opportunities arising from VCPs. The ability to monitor multiple timeframes simultaneously is particularly valuable for scalpers, as it allows them to see the bigger picture while focusing on the smaller timeframe for entries.

- Intraday Traders: Multi-Timeframe Perspective: Intraday traders often use a combination of timeframes for analysis. This indicator provides a comprehensive view of VCPs across daily, weekly, and monthly charts, helping intraday traders understand the broader context of price action. This allows them to identify breakouts that are aligned with the overall trend on higher timeframes, increasing the likelihood of a successful trade.

- Options Traders: Options trading requires precise timing and smart contract selection. This tool helps you get it right, identifying potential price breakouts so you can choose the right calls or puts and enter your positions at the optimal moment, minimizing time decay.

- Trend Traders: Trend trading strategies often leverage a multi-timeframe approach. Identifying the trend is crucial in trading. Successful trading often hinges on capturing the prevailing trend. This is typically achieved by analyzing higher timeframes to identify the overall direction and then employing lower timeframes to pinpoint optimal entry and exit points.

The Volatility Contraction Pattern (VCP) has a high success rate, especially in strong markets. Studies show that 60-70% of VCP breakouts lead to solid price rallies when they break out with strong volume. This consistency makes the VCP a popular choice among traders, particularly in bull markets where institutional buying pushes prices higher. When volume confirms a breakout, it shows that demand is outpacing supply—a key sign of strength.

Note: This VCP indicator highlights potential breakout zones to help you capitalize on significant price moves ("ride the wave"). However, it does not provide buy/sell signals (based on trend, labels or arrows). Your individual trading strategy will determine your entry and exit points, as well as the duration of your trades.

Release Notes

Mar 16 2025

Enhanced Signal Versatility: The hierarchical logic allows for a more nuanced approach to VCP detection, catering to different trading styles and risk tolerances.

User-Defined Volume: Allows for adjustable volume thresholds for each timeframe, enabling customization based on specific market conditions and asset characteristics.

New Update includes:

Hierarchical Logic:

- The indicator starts with the most stringent criteria:

- Volatility contraction (defined by decreasing highs and increasing lows).

- Volume exceeding a user-defined threshold.

- All candles within the VCP pattern being bullish (green).

- If the most stringent criteria are not met, the indicator progressively relaxes the conditions:

- First, it checks for VCP with volume exceeding the threshold, regardless of candle color.

- Finally, if that fails, it checks for VCP based on volatility contraction alone.

Configurable Volume Thresholds:

- Users can set separate volume thresholds for daily, weekly, and monthly timeframes through input parameters.

Rs: 500 Month

Rs: 3500 Lifetime

$45 Lifetime

Benefits of Multi-Timeframe VCP for Scalpers

For a scalper, utilizing a VCP strategy with multi-timeframe analysis offers significant advantages, primarily focused on enhancing precision and speed in their very short-term trading:

-

Enhanced Precision in Entry and Exit Points:

Scalping relies on capturing very small price movements. By using multiple timeframes, a scalper can gain a more comprehensive view of the market. They can use higher timeframes to identify the overall trend direction and potential areas of support and resistance, and then use lower timeframes to pinpoint precise entry and exit points. This greatly increases the probability of successful trades.

-

Faster Identification of Breakout Opportunities:

VCPs signal potential breakouts. By monitoring VCPs across multiple timeframes, scalpers can identify high-probability breakout opportunities more quickly. If a VCP breakout is confirmed across multiple timeframes, it indicates a stronger and more reliable signal. This allows scalpers to capitalize on rapid price movements as soon as they occur.

-

Reduced False Signals:

Scalping involves a high volume of trades, which increases the risk of encountering false signals. Multi-timeframe analysis helps to filter out noise and confirm trading signals. By ensuring that VCP patterns and breakouts align across multiple timeframes, scalpers can reduce the likelihood of being misled by temporary price fluctuations.

-

Improved Risk Management:

Scalpers must manage risk very tightly. Multi-timeframe analysis helps them to set more accurate stop-loss orders and take-profit targets. By considering the broader market context, scalpers can avoid placing stop-loss orders too close to potential support levels or setting take-profit targets too far from resistance levels.

-

Increased Confidence:

Seeing confirmation of a VCP pattern across multiple time frames increases the confidence a scalper has in there trading decisions. This is very important when trades are happening in seconds.

In essence, multi-timeframe VCP analysis empowers scalpers to make more informed, rapid, and precise trading decisions, ultimately enhancing their profitability and risk management.

Visual Aids and Dashboard:

Pivot Point Lines: The indicator plots the multi-timeframes high and low levels as lines directly on the chart, making it easy to visualize potential breakout zones. Users can customize the line style and labels.

Real-time Breakout Detection: The script continuously monitors price action and, on breakout, shows an arrow with the label of the timeframe where the breakout occurred.

Informative Dashboard: A table is displayed on the chart, providing a quick overview of the VCP status for each timeframe. It shows whether a VCP is "Active," "Inactive," or has just "Started" (meaning the VCP pattern has been detected and the trend is ongoing). "Increase TF" symbolizes that the VCP cannot be fetched. Change to a higher timeframe to know the exact status. The table also displays the VCP high and low values.

Alerting System:

Customizable Alerts: The indicator offers a highly customizable alerting system. Traders can choose to receive alerts for:

Convergence Alerts: A key advantage of this scanner is its ability to detect convergence. This occurs when breakouts happen on multiple timeframes concurrently (e.g., a buy breakout on both the TF1 and TF2 and TF3 charts). Convergence signals a potentially stronger move as multiple timeframes align.

- Breakouts on individual timeframes or

- Convergence breakouts (e.g., TF2/TF3 convergence).

Recommended Timeframes for VCP Breakout Detection

"Our indicator is versatile and functions across all minute-based timeframes. However, for optimal performance and to align with common trading strategies, we suggest to use these timeframe combinations in indicator settings.

5, 10, 15 minutes

5, 15, 30 minutes

15, 30, 60 minutes

20, 40, 60 minutes

"To optimize your trading strategy, we encourage experimentation with various timeframe combinations. However, please ensure that all inputs adhere to the ascending order requirement to maintain indicator accuracy."

Traders are drawn to the Volatility Contraction Pattern (VCP) due to its impressive success rate, especially in thriving markets. Studies reveal that 60-70% of VCP breakouts, backed by strong volume, trigger powerful price rallies. This consistent performance makes the VCP a favorite during bull markets, where institutional buying fuels price appreciation. Volume confirmation during a breakout signals a surge in demand outpacing supply, a definitive sign of market vigor.

Note: This VCP indicator highlights potential breakout zones to help you capitalize on significant price moves ("ride the wave"). However, it does not provide buy/sell signals (based on trend, labels or arrows). Your individual trading strategy will determine your entry and exit points, as well as the duration of your trades.

Rs: 500 Month

Rs: 3500 Lifetime

$45 Lifetime

Required Settings

For All Indicators : * Settings -> Canvas : Chose Background Solid and White color, then set Grids lines to none

* Before adding the indicator to the chart, turn off the automatic data adjustment in the

corner of the price scale (by clicking A).

(To prevent the Horse Breakout Levels

from being squashed)

* Order of adding the indicatiors must be

1) Horse Breakout Stations2) Horse Volume Pivot

* Settings -> Symbol section : To display the background color for the start and end of the session, you should select the extended trading hours.

View In Detail with ImagesBasic Use & Understanding

* For clearer analysis, toggle the Horse Volume Pivot and Horse Station indicators on or off to isolate their respective levels and trends. This creates a cleaner, easier-to-understand chart.

Still need help you can reach me @ +919867408528

About Me:

My journey began over a decade ago in code, where I developed 50+ websites and 15+ Android apps. That analytical, "hacker" approach – a relentless hacker's determination – naturally led me to the stock market, a system ripe for optimization. But the harsh reality of personal trading, marked by frustrating losses despite every indicator imaginable, showed me the true complexity. It wasn't about simply finding signals; it was about engineering a superior trading engine. This drive directly led to the creation of the Horse Volume Pivot and Horse Breakout Stations.

We're not just building indicators; we're crafting intelligent trading solutions. Get ready to experience the next evolution in market analysis – more breakthroughs are on the horizon!

Trading Videos

Do Like, Share & Subscribe to my Youtube Channel To get new upcoming videos to your Inbox.

"Please note: These videos feature an older version of Horse Volume Trend. The current version has been significantly enhanced, now incorporating the high-probability algorithms of Horse Volume Pivot. My commitment is to prioritize ongoing indicator development, ensuring traders have access to the most effective tools."

How to Set Up Alerts with Horse Volume Pivot

(*) Horse Breakout Stations - Explanation

Coming Soon, Horse 12 Stations Aggregated Approach

1) Horse Breakout Stations - Strategy : 6 Hrs - 15 Min

2) Vwap Month & Vwap Yearly Strategy : 2 Hrs

3) Weekly High Strategy : 20 Min

4) Weekly High Yesterday Broke Strategy : 50 Min

5) Lower Low Candle Strategy : 50 Min

Gain Lifetime Access & NEVER Pay Again.

₹ 1800 $25 Lifetime

1) Horse Volume Pivot

2) Horse Breakout Stations

₹ 6000 $80 Lifetime

1) Horse's VCP Eye View (Swing)

2) Horse's VCP Eye View (Scalper)

ALL 4 Above ₹ 6666 $99 Lifetime

1) Horse Volume Pivot

2) Horse 12 Stations Aggregated Approach

3) HORSE Winning Strategy Analyzer

₹ 99000 $1200 Lifetime (My favorite)

Horse's Full Ride - Golden Offer

Buy Any Plan

Take ALL Indicators Access for 1 Months

For PayPal : rishikesh579@gmail.com

Or Paying by UPI Id : 9867408528@pthdfc

rishikesh579@okhdfcbank

After payment, Please Whatsapp me your payments screenshot and share your tradingview

username.

So I can grant you access.

Happy trading!

Scan below QR Code to Pay

Exciting Opportunity: The Entire "Horse Trading Indicators" Brand is For Sale!

After years of dedicated development and serving the TradingView community, I've decided to explore new ventures. This is a unique opportunity to acquire a complete, proven brand of Pine Script indicators.

Asking Price: ₹60 lakhs 69,768 $

If you're an individual or entity looking to own a recognized and performing suite of trading tools, I invite you to get in touch for a confidential discussion.

For serious inquiries, please contact me directly at: rishikesh579@gmail.com